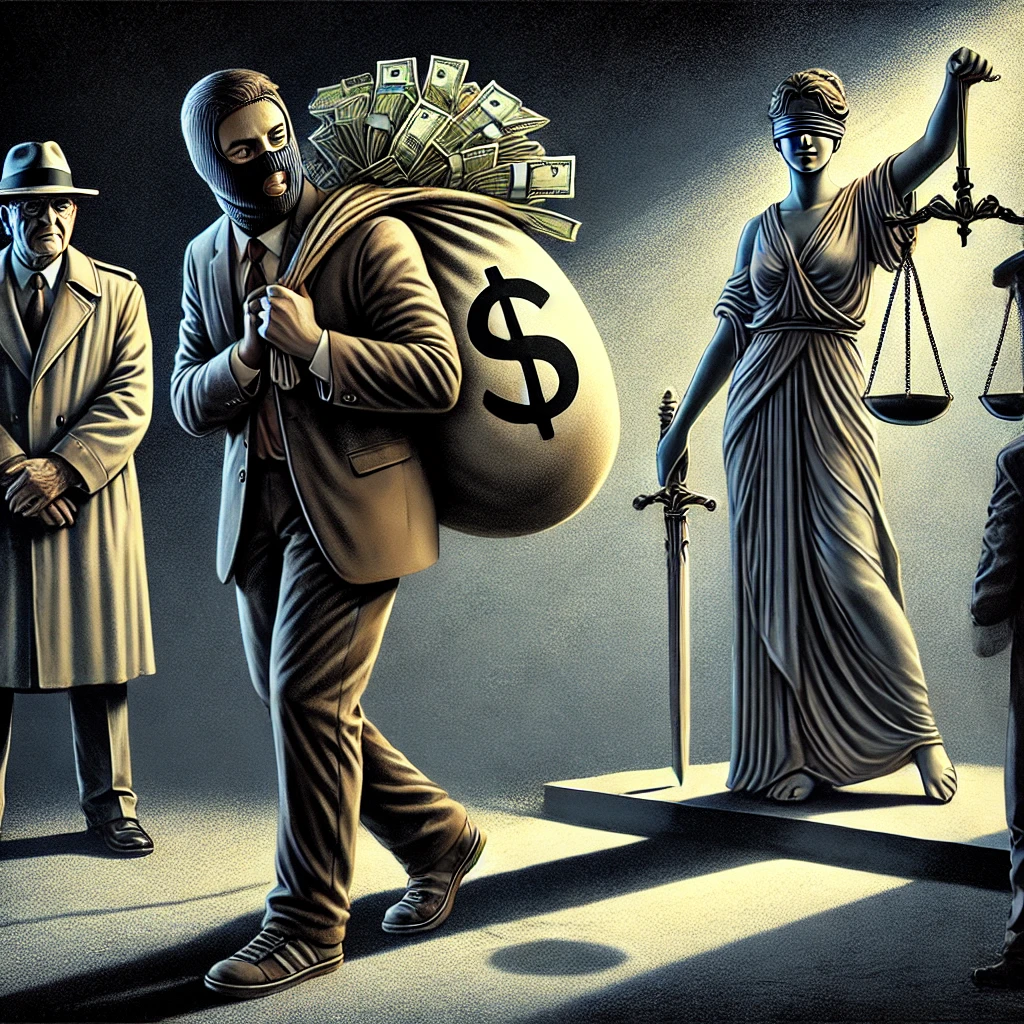

A recent court case has again highlighted the complex role of the so-called “money mule” in fraud cases. Geldezel argued a defense in the proceedings.

What is a money mule?

A money mule is someone who makes their bank account available to criminals to channel stolen money. This is often done under the guise of a lucrative side income or under pressure from the criminals. The money mule receives money in his account from a fraud and is then asked to transfer it to another account or withdraw it in cash. Sometimes a money mule transfers control of his bank account entirely to a criminal. A criminal does this in this way to stay out of the picture himself.

The complex position of the money mule

Money mules are in a precarious position. Often they themselves feel victimized, misled by criminals who remain hidden. In some cases, there may be intimidation or fear of the real perpetrators. However, by making their bank accounts available, money mules are taking a huge risk. They risk a high debt to the victim because they themselves are not entitled to receive the payment.

Legal implications

A recent ruling by the Gelderland District Court (ECLI:NL:RBGEL:2024:4948) illustrates the legal consequences for money mules. In this case, a victim of bank helpdesk fraud was defrauded of €42,112.71. The money was transferred to the accounts of two money mules. It was not clear to the plaintiff whether these individuals knew each other. He found that both persons owed the entire amount (joint and several liability). With joint and several liability, the creditor can sue one person for the entire amount and then that person has to see if he can claim the other person’s share. Joint and several liability under Art. 6:166 of the Civil Code requires some form of cooperation between the perpetrators. This was a blind spot for the plaintiff, although it was clear that the unknown criminal used both money mule in siphoning off the money.

Key points from the verdict:

-

Undue payment: The court ruled that there was undue payment (Art. 6:203 BW). The money mules had to repay the amount received.

-

No joint and several liability: The court dismissed the claim for joint and several liability because it was not proven that the money mules worked together.

-

Rejection of defenses: Defenses based on Article 6:204 BW (no need to consider repayment) and Article 6:248 paragraph 2 BW (reliance on reasonableness and fairness) were rejected.

-

Own fault not applicable: The court emphasized that the own fault defense (Art. 6:101 BW) does not apply in the case of undue payment.

Conclusion

This ruling confirms that victims of fraud have a strong legal position against money mules. The claim for reimbursement is usually awarded regardless of whether the money mule was aware of the fraud. It is therefore crucial that people be aware of the risks of lending their bank accounts and not be tempted to engage in such practices.

As an attorney for victims of fraud, it is essential to alert clients to the possibility of holding money mules liable. Although money mules can sometimes be seen as victims themselves, the law offers little room for defense against repayment of undue funds.

Read the verdict here