As a specialized firm in crypto fraud cases, we regularly see how victims struggle to recover their stolen digital assets. Although we have explained in previous blogs how accounts at cryptoexchanges can be frozen via a Dutch court order, even at foreign exchanges, this measure sometimes comes too late. Fraudsters have sometimes been able to clear accounts before any action can be taken. Every case is a race against the clock.

An additional problem is the reluctance of exchanges to provide information about their customers, even when fraud is suspected. However, this situation has taken a significant turn thanks to a recent Amsterdam court ruling.

The case

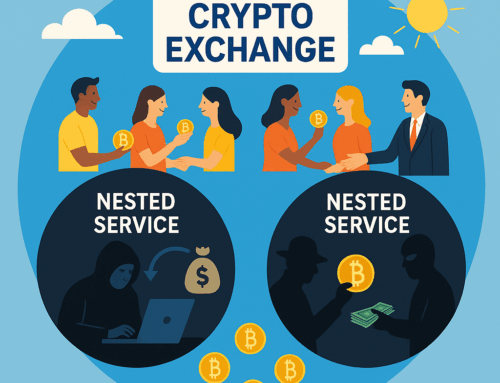

In a case against Kraken, a well-known and large cryptoexchange, the Amsterdam District Court handed down an important decision on December 24, 2024. The case involved an investment fraud in which the deposits had been deposited by bank to an intermediary, a so-called “money mule.” The latter had used the stolen money to buy cryptocurrencies from Kraken’s platform. The judge had previously issued an order to freeze the account to secure the crypto for the victims, but the crypto had been forwarded through Kraken to the suspected fraudster who thus remained anonymous and hidden. The judge ordered Kraken to make full disclosure of all transactions within the account in question, including transactions that occurred after the point where blockchaintracing ends. Blockchaintracing is the investigative method we use to track cryptocurrency shipments.

Kraken’s defense

Kraken argued that they could not be required to provide information about transactions that occurred after receiving the cryptocurrency at the deposit address. Their argument was that this information request went too far and would violate their customers’ privacy, even if fraud was involved.

The judge rejected this defense. He ruled that the interests of fighting fraud and the right of victims to be compensated for their losses outweighed the exchange’s privacy concerns. Moreover, the judge stated that by facilitating transactions, the exchange bears some responsibility in preventing and combating fraud.

The possibilities and limitations of blockchaintracing

Blockchaintracing is an investigative method to track stolen or fraud-generated cryptocurrency from the address on the victim’s blockchain to the blockchain address used by the fraudster to cash out. The latter can be done at a cryptoexchange, such as Kraken. The fraudster can use the platform in various ways to launder the loot and cover tracks. For example, he can sell stolen digital assets through the platform to another customer of the platform who does not know the crypto was stolen (a so-called “good faith third party”). To understand the meaning of this statement, it is important to know the limitations of blockchaintracing:

-

Blockchaintracing ends at an exchange’s receiving or deposit address, and thus does not always reflect a fully completed pathway.

-

Further movements within the exchange are not recorded on the public blockchain, but in the platform’s internal records.

-

Fraudsters can use an exchange as an intermediate station to forward crypto to other platforms, which is extra concealing. It’s like walking on a road that ends at a bridge that has been pulled up, so you can’t continue, knowing that the stolen cryptocurrency has crossed the bridge and moved on across the road.

These restrictions put fraud victims at a disadvantage because they may lose the track record of their stolen assets as soon as they arrive at an exchange.

The impact of the ruling

The Amsterdam court’s decision has potentially far-reaching implications:

-

The tactic of using exchanges not as an end station but as an intermediate station to cover up tracks and stay out of sight becomes less effective.

-

Victims and their lawyers will have access to crucial information about the movements of stolen cryptocurrencies within exchanges.

-

This ruling can serve as an example for similar cases, not only in the Netherlands but possibly internationally as well.

-

Platforms are forced to cooperate more actively in fraud investigations and can less easily hide behind privacy arguments.

This ruling marks a step forward in the fight against crypto fraud. By requiring exchanges to provide full disclosure of transactions within their platform, the possibilities for victims to trace, freeze and recover their stolen cryptocurrency are strengthened. They can now “search through the exchange,” so to speak, with the help of a judge. The case shows that the legal system is adapting to the challenges of the digital financial economy and is willing to formulate innovative solutions to protect victims’ rights.

For victims of crypto fraud, this means a greater chance of success in recovering and reclaiming their stolen assets. It also underscores the importance of acting quickly and seeking specialized legal help when dealing with crypto fraud.

Read the December 24, 2024 ruling here